- Robinhood stock dropped 12% Wednesday after Q3 results missed analyst estimates.

- Crypto trading revenue fell 78% from the prior quarter to $51 million.

- "Crypto activity came off record highs leading to fewer new funded accounts and lower revenue," CEO Vlad Tenev said.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Robinhood's stock tumbled as much as 12% on Wednesday after its third quarter results missed analyst estimates on revenue.

The trading app's total quarterly net revenue came in at $365 million, lower than a Refinitiv estimate of $431.5 million. Revenue rose 35% on an annual basis, but was much below the second-quarter figure of $565 million.

Robinhood posted a net loss of $1.02 billion, or $2.06 per share. That is below the Refinitiv estimate of a loss of $1.37 per share.

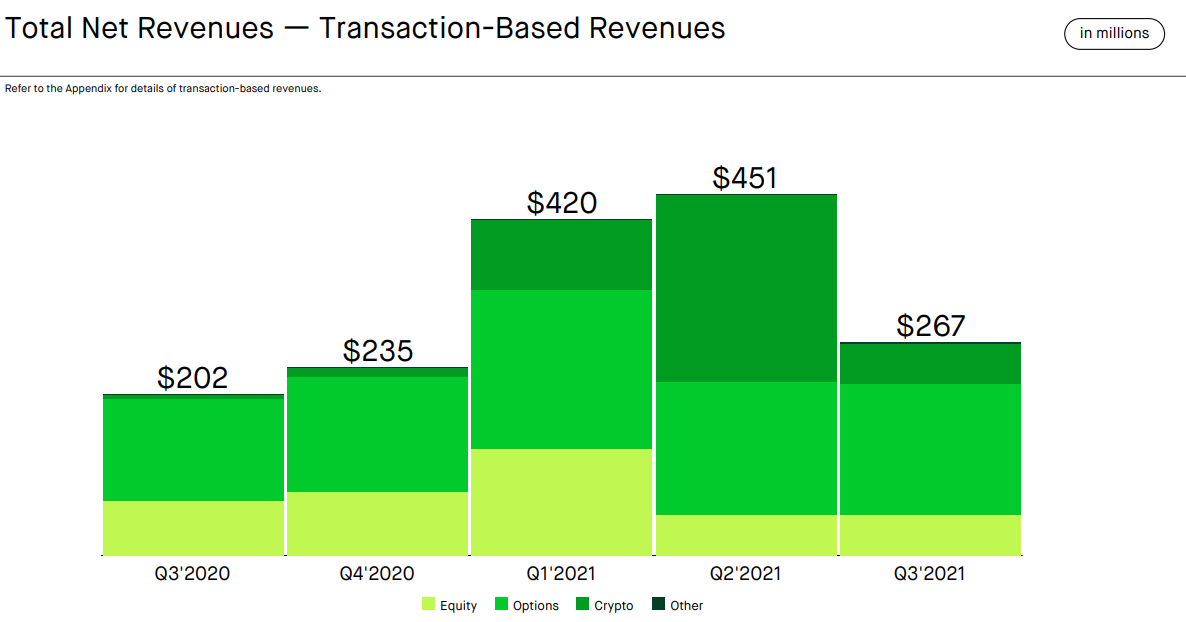

Transaction-based revenue came in at $267 million, with revenue from crypto trading falling 78% from the prior quarter to $51 million.

Robinhood said its second-quarter revenue from crypto transactions, of which dogecoin made up 62%, was much higher at $233 million. The company didn't specify which crypto asset was the most popular in Q3.

"In Q3, crypto activity came off record highs leading to fewer new funded accounts and lower revenue as expected," CEO Vlad Tenev said in an earnings call on Tuesday. "Historically, our growth has come in waves. The surges have come during periods of increased volatility or market events."

Robinhood warned investors that factors impacting its third-quarter results, like lower crypto trading, are likely to persist into the next quarter.

Net cumulative funded accounts fell to 22.4 million in Q3, from 22.5 million in the second quarter. Monthly active users fell to 18.9 million, down from 21.3 million in the previous quarter. Average revenue per user fell 36% year-on-year to $65, versus $102 in the same period last year.

"Our industry sees a typical seasonality curve that shows higher growth in the first quarter of the year versus the last three quarters," CFO Jason Warnick said. "We continue to monitor regulatory developments relating to market structure matters such as statements from the SEC on payment for order flow, cryptocurrency regulation, option trading due diligence, and digital engagement practices."

In the absence of changes to the market environment, Robinhood said it expects to generate revenue no greater than $325 million in the fourth quarter and full year revenue of less than $1.8 billion.

Robinhood's shares last traded at $34.76 per share in early trading on Wednesday. Bitcoin slumped 6% to below $59,000, with one analyst saying Robinhood's results may have been a factor.

Bitcoin's sharp correction has turned the recent bullish outlook lower, Nicholas Cawley, analyst at DailyFx, said. "While there are no confirmed reasons so far for the move, market sentiment may have been damaged after Robinhood released disappointing earnings last night with revenue from crypto activity seeing an unexpected slump," he added.